In the fast-paced landscape of today’s business world, where growth is the ultimate goal, sales teams play a pivotal role. However, a growing concern looms over growth companies: the scarcity of skilled salespeople.

In this article, we will dig into the causes of this shortage, dissect its adverse impacts on growth companies, and explore the strategic measures that business owners, CEOs, and boards of directors must adopt to successfully navigate this challenge.

The Cause: Unveiling the Underlying Factors

It doesn’t take much time on Google to surface a ton of credible research that paints a vivid picture of the state of modern sales forces today. Whether you lead a sales force of 1 or 1000+, you can’t escape the reality of the situation.

- Only 8% of salespeople today follow a reliable sales process (Objective Management Group). The rest shoot from the hip.

- Salespeople turnover 2 to 3 times more often than the general workforce (Harvard Business Review). Recruiting is still a guessing game for most hiring managers.

- Only 16% of sales leaders believe they have the talent required to hit their numbers (Gartner). Sales leaders see the problem and are still searching for a solution.

- The average tenure of a growth company CRO and VP Sales has shrunk to 16 and 14 months, respectively (Pavilion). Accepting the growth challenge is easier than delivering on it.

- And, today, the odds of a successful salesperson closing a forecast deal are nearly the same as winning a pass bet at a Vegas craps table: 49.3% (Sales Mastery). Sales leaders today are still rolling the dice and expecting to get lucky.

How have CEOs of small, medium, and large companies responded? By spending an incredible amount of money:

- $800 billion a year on sales force compensation (HBR)

- $66 billion a year on sales enablement technology (HubSpot)

- $22 billion a year on sales training (Association for Talent Development)

So why aren’t these investments moving the needle?

One key factor is the evolving nature of sales itself. Sales roles have transcended traditional transactional approaches to embrace consultative, value-based, and relationship-driven strategies. As a result, companies demand salespeople who not only possess basic sales acumen but also exhibit:

- Sophisticated rapport-building and leadership skills.

- A profound understanding of the customer’s business and industry.

- A sincere interest in their buyers’ roles, responsibilities, and political risk factors.

Unfortunately, much of the training that’s available today has its roots in concepts that were first introduced by IBM in 1916, and by Xerox in 1968. If you’re still using BANT, for example, you’re using a transactional sales tool introduced by IBM in 1950. And unfortunately, modern versions of the same tool, such as MEDDICC and MEDDPICC, offer little measurable improvement.

These acronyms may be easy to remember, but they still limit seller and buyer to a transactional experience.

On top of this, a significant portion of existing sales forces lack the digital acumen required to thrive in an era dominated by technology. The rapid evolution of data analytics, artificial intelligence (AI), and related productivity tools means that sales professionals must continually upskill to stay relevant.

Unfortunately, the vast majority of sales training delivered today does not reflect the current sales environment. Not only have rudimentary sales skills not kept up with new demands of the profession, but most sales training falls short of delivering higher order skills. Which means what is taught simply does not deliver on the promise.

As a result, what is taught is not reinforced by managers or retained by reps.

Research from the Association for Talent Development (ATD) supports this conclusion, reminding us that most salespeople forget between 84% and 90% of their training within 90 days.

Negative Effects: How Growth Companies Are Impacted

The shortage of skilled salespeople casts a looming shadow over growth companies, impacting their bottom lines and long-term sustainability.

Some of the negative effects include:

1. Stalled revenue growth

Sales teams are the lifeblood of growth companies. A scarcity of skilled salespeople hinders the organization’s ability to qualify and convert prospects into new customers.

In today’s market, customers seek personalized and tailored solutions. Skilled salespeople are adept at understanding their buyers’ desires and frustrations, exposing known and unknown points of friction, understanding the buyer’s unique definition of value, building meaningful relationships, and leading buyers to change.

The shortage of skilled salespeople means bottlenecks form in your sales pipeline, resulting in stalled opportunities, lost deals, missed forecasts, and budget shortfalls that prevent your company from fully investing in growth.

The shortage also degrades your customers’ experience, which compromises their loyalty, lowers retention rates, weakens your competitiveness, and lowers the overall effectiveness of your account management and customer success teams.

2. Inefficient resource allocation

In response to sales forces that cannot consistently hit their numbers, companies are diverting resources to paying richer compensation plans, as well as implementing sales enablement technologies that they believe will lower their reliance on salespeople.

This strategy has not worked. Instead, the strategy has created an environment where the underperforming “BOTTOM 80%” of sales forces are being paid more for producing less. At the same time, these poor performers are costing more to onboard due to the increased expense of licensing and training reps who need access to a bloated tech stack.

Less than 2% of sales leaders say they are very satisfied with their current sales tech stacks (Gartner). And, as I mentioned earlier, 84% still don’t believe higher compensation and improved sales stacks have delivered them the talent required to hit their numbers.

3. Flawed data and decisions

In the midst of all this uncertainty and stress, the scarcity of skilled salespeople can also cause CEOs and their leaders to make incorrect assumptions about the potential of their sales force and business.

A shortage of skilled salespeople means too many CEOs don’t know what it is like to work with “TOP 20%” sales talent. CEOs in this situation can see world class salespeople as unicorns, mythical creatures that are born, not made. They can also become convinced that their own offerings are hard to sell or can’t be sold by traditional salespeople.

These CEOs can develop a fixed mindset that overvalues the negative performance and excuses of their BOTTOM 80%ers. And in the most extreme cases, CEOs can simply stop seeking to raise the bar for their sales force. They make the unconscious mistake of accepting the status quo.

I had a client once who built one of the fastest-growing companies in her industry over 15 years. 99.9% of her growth over that time came from partners and existing customers, not her new sales team. When I finally met her sales reps, I learned that they had not closed a legitimate new customer in more than five years.

The founder was able to find a faster path to cash that was more predictable than investing in her new sales team. So she rode the wave for as long as she could and allowed her new sales team to fend for themselves.

It’s human nature to seek the path of least resistance, but it can also come with a huge opportunity cost.

Imagine how much more valuable her business would have been if her sales engine was firing on all cylinders.

Navigating the Crisis: Finding a Strategic Solution

What we know for sure is that traditional approaches to sales training, bloated sales tech stacks, and rich compensation plans have simply not moved the sales performance needle in the last decade.

And, since companies have largely not learned how to successfully develop their salespeople, we have fewer salespeople who are prepared for success. Which means the global pool of skilled sales talent continues to shrink.

How do we break the cycle?

Well, colleges and universities have been attempting to address the problem. I remember working with a certain university in Cambridge, MA, to develop their sales club back in the 1990s. 25 years later, the best programs we have still only offer a sales certificate and are largely taught by folks who have never made a living in sales. It’s hard to build a sales career on theory.

Bottom line: growth companies will have to learn how to develop and support their own “TOP 20%” sales talent.

Based on the experience of our clients over the last 17 years, success will require the adoption of a multi-faceted solution—the development of a complete sales operating system.

With the right sales operating system, for example, it will take 2 to 4 months to prepare a new sales hire to engage with buyers, 6 to 9 months for them to fill their sales pipeline, and 12 to 18 months to become a consistent top performer.

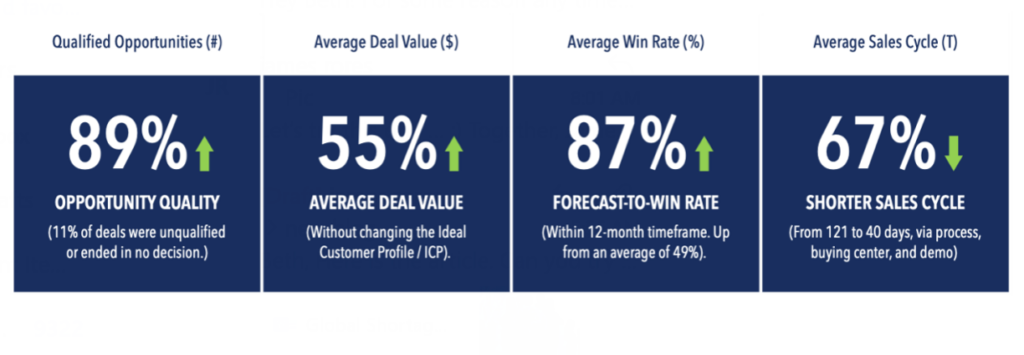

For existing sales teams, you can expect engaged team members to achieve significant improvements within 12 months of their training, including the following client-reported stats:

Developing a complete sales operating system from the ground up may sound complicated. But most companies don’t have to build their sales operating system from the ground up.

In our experience, the most successful sales transformations require leaders to simply identify and close the gaps within their existing sales operating system. This saves time and money while allowing the sales force to continue selling as they’re transforming.

Q: What’s one of the best ways to identify and close the gaps?

A: Through the proper use of training and coaching.

Think of training as a tool to teach your reps about their gaps, i.e., what’s working and what’s not working. And think of coaching as a tool to help your reps close their gaps, i.e., embrace the mess of breaking old habits and building new ones.

What’s Next?

While the global shortage of skilled salespeople is a problem, it’s a problem that employers can solve. We took data from 10,000 working sessions across more than 100 industries and identified a universal path to success called the WINS Model™.

WINS is an evidence-based sales and leadership model that identifies and closes the gaps that exist within your people, process, playbook, and pipeline to form the foundation of a new sales operating system.

If you’re curious about the impact WINS can have on your sales force, you may want us to conduct a gap analysis of your current sales operating system.

For a limited time, qualified sales teams can receive this gap analysis free of charge by emailing “Gap Analysis” to grow@florissgroup.com.

And if you plan to be in Columbus, OH, on October 12, 2023, consider joining our CEO Revenue Roundtable, overlooking the 18th green at Muirfield Village. We will be spending the day sharing the latest on how to predictably scale sales and revenue in 2024. Seating is limited and reserved for CEOs and their revenue leaders. You can learn more here or by reaching out to us at grow@florissgroup.com.

I guarantee insights you will not hear anywhere else!

Together,